H.S Code Amendments

Tariff Classification 2022

H.S. Code Amendments Effective January 1st, 2022

With major changes to the tariff schedule taking effect January 1, 2022, importers should review existing tariff classifications for their products. Frontier’s team can provide assistance to importers preparing for the 2022 HS code amendments.

What Importers Need to Know

Every five years the World Customs Organization (WCO) reviews the HS code to ensure it stays up-to-date in regards to new technologies, product streams, changes in trade and other global issues.

Some major changes to the HS code for 2022 will include 351 sets of amendments covering a wide range of goods moving across borders. Changes to the HS will affect classification at the four- and six-digit level for participating countries worldwide. This will include, new headings and subheadings, modified article descriptions, and new or revised legal notes.

Distribution of Amendments by Sectors:

77

Agricultural, Food & Tobacco Sectors

58

Chemical Sector

31

Timber Sector

21

Textile Sector

27

Base Metals Sector

63

Machinery, Electrical, & Electronic Goods Sectors

22

Transport Sector

52

Other Sectors

To view the 2022 Customs tariff chapter-by-chapter (T2022), please visit the Canadian Border Service Agencies website.

What Importers Need to do

Identify products that need to be updated

Identify products that need to be updated by reviewing your database. Then compare your database against the Concordance Table found at the link to the right. The table provides the current, changing tariff classification with the associated updated HS code.

Review Your Database

Ensure that your internal database is updated

CBSA, when reviewing an auditing an importer, always prefers to see that the importer has some internal control related to the tariff classifications that are used when accounting for imported goods.

Frontier would be pleased to provide a quote to update the tariff classifications that are changing. We can identify the targeted products and work together to ensure that the information is accurate.

It should also be noted that any change should not have an effect on the rate of duty, which is not the purpose of this update. It is also crucial to know that using an inaccurate tariff classification, even for duty free products, will create exposure to Administrative Monetary Penalty.

Want to Learn More About the H.S Code?

Tariff Classification and the 10 Digit H.S Code

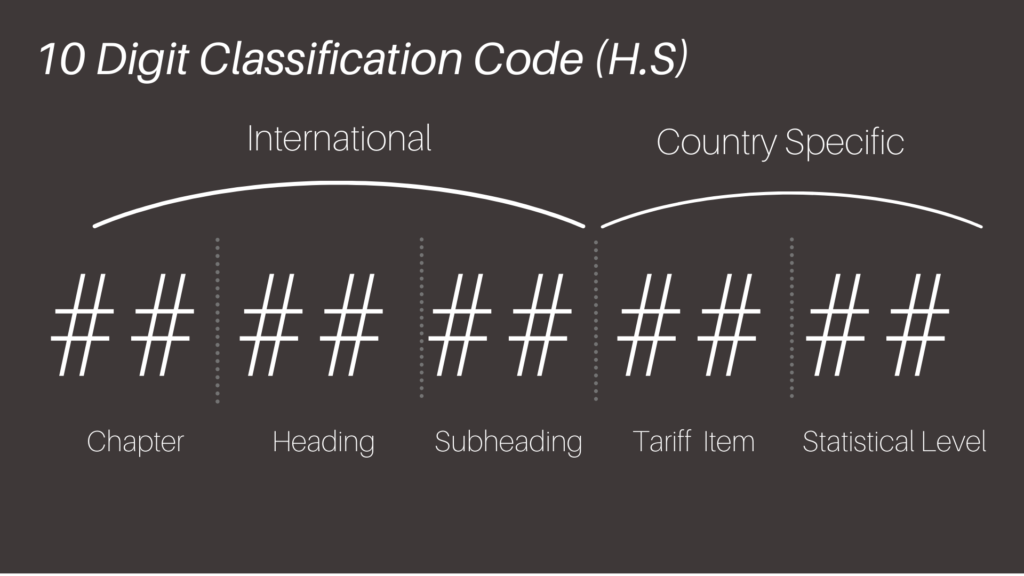

The Harmonized Commodity Description and Coding System (H.S Code) allows every individual item being either imported or exported in international trade to be categorized and monitored. Based on its categorization, a duty rate is assigned to every commodity that enters the commerce of another nation. The CBSA recognizes the internationally used H.S Code.

Shown on the right is the basic breakdown of the 10-digit H.S code. The first six digits represent the international part of the classification number and used by all countries that recognize the HS system. Following are the last four digits which are country specific and reflect Canadian tariff and statistical requirements.

For any goods imported into Canada, using the HS Code is mandatory for classification and important to do properly.

The 10 Digit H.S Code Breakdown