Non-Resident Importer

How to Guide

What is a Non-Resident Importer?

Becoming a Non-Resident Importer (NRI) allows a company that resides in the U.S to sell their products in Canada, without requiring a physical Canadian location.

A licensed Customs Broker, can help an NRI ensure that their shipments are being imported properly. This allows them to successfully sell to Canadian consumers. Frontier can obtain and prepare the customs release documents needed by the CBSA, arrange payment of customs duties and taxes, secure the release of imported goods, and generally make it easier to navigate the customs process.

Advantages of being a Non-Resident Importer:

Canada’s population is roughly 38 million, 90% living within 100 miles of the U.S-Canada border. This number of potential customers provides U.S. based companies the opportunity to increase their sales by up to 10 percent by expanding into the Canadian market.

Becoming an NRI creates more control over your company’s supply chain. This control helps to decrease associated costs along the way for both you and your customers. Reduced operating costs occur, as it eliminates the need to invest in physical locations such as: manufacturing & distribution facilities, or other offices. Additionally, your company gains a larger consumer base (in Canada), while becoming more available to these customers.

Key components to operating as an Non-Resident Importer:

- Business Number (BN)

- Valuation

- HS Tariff Classification

- Tariff Treatment and USMCA

- Goods and Services Tax (GST) on imported goods

- Canadian Customs Clearance

- Maintenance of Records

- Compliance

Business Number (BN)

The first step to becoming an NRI is obtaining a BN. This number identifies who you are and how you operate in Canada. It allows the CBSA to monitor your interaction in the Canadian market in areas such as: income tax, payroll, GST & HST, and import & exports. Having a BN is a required component to become an NRI and conduct CRA business with a single contact.

Required documents for imports

- Vendor and purchaser name and address

- Importer of record

- Full description

- Country of origin

- Quantity (packages and weight)

- Value (Unit price and extension)

- Currency of settlement (U.S. or Canadian dollars)

- Condition of sale

Certain commodities entering Canada may need additional documents (i.e. permits, certificates, licenses, and bills of lading). If the good is not accompanied with these documents then the CBSA may restrict or control the goods for various reasons. View CBSA’s full list here.

Valuation

Duty rates depend on several factors; the type of good being imported, the country from which the good came from or was produced in, and the selling intention. The Customs Act helps determine how much duty will be placed on a good based on its value. Determining the value is most commonly done by using the transactional value method. This method states that all imported goods will be valued at the price actually paid or payable for the goods when sold for export.

Transactional value method:

The CBSA outlines four basic questions for determining transactional valuation:

- Has a sale occurred?

- Was there a sale for export to Canada?

- Was the sale for export to Canada to a purchaser in Canada?

- Can the price paid or payable for the goods be determined?

Visit their page to read in more detail:

Tariff Classification & Treatment:

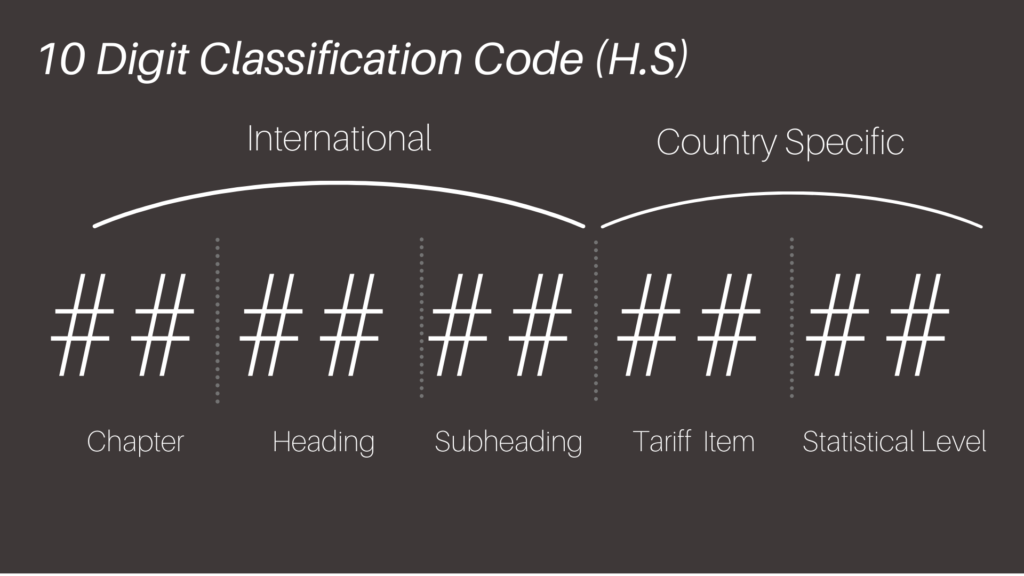

A tariff is a tax that gets imposed on imports & exports from one country to another. Classification is the process of determining the proper 10 digit code for importing and exporting goods to determine the associated cost added on to the goods at the border.

The CBSA recognizes the internationally used Harmonized System code (H.S code) which consists of 10 digits to help identify each good.

Shown on the right is the basic breakdown of the H.S code. The first six digits represent the international part of the classification number and used by all countries that recognize the HS system. Following are the last four digits which are country specific and reflect Canadian tariff and statistical requirements.

For any goods imported into Canada, using the HS Code is mandatory for classification and important to do properly.

Tariff Treatment & Trade Agreements:

A method used to establish the rate of customs duty for a given tariff classification. Tariff treatments generally lower the rate of duty that would normally be payable on imported goods. Canada provides preferential treatment for certain goods to countries that we have trade agreements with. The “United States – Canada – Mexico Agreement” (USMCA) is an agreement with the intention to promote trade among the three countries. Imported goods need to meet the origin requirements and have the proper paperwork accompanying them at the time of importation. Doing so will reduced or eliminated tariff rates. This agreement has encouraged competitiveness and trade between the U.S and Canada by eliminating common barriers at customs and easing the importing process.

Make sure you have the proper documentation at the border: Certificate of Origin Form.

GST & HST for Non-Residents

GST

Goods and Services Tax (GST) is a value-added federal tax implemented by the Government of Canada. This tax is imposed on most goods and services that are sold for domestic consumption at a rate of 5%.

HST

Harmonized sales tax (HST) combines the federal Canadian goods and services tax (GST) and provincial sales taxes (PST). View the full list of provinces that use the HST structure and their rates here.

For imported goods that are meant for commercial use throughout Canada, GST/HST will be applied at Customs. This tax is collected by the CBSA on behalf of the CRA

Canadian Customs Clearance

There are three different options for invoicing when shipping to Canada:

- a Canada Customs Invoice (CCI) which either you or the vendor can complete;

- a commercial invoice containing the same information as a CCI; or

- a commercial invoice which indicates the buyer, seller, country of origin, price paid or payable and a detailed description of the goods, including quantity, and a CCI that provides the remaining information.

Become an NRI with our help

Frontier’s collaborative services and knowledgeable team of Customs Brokers can help interested U.S. companies successfully become an NRI. With our assistance, you will be able to effectively expand your business by selling in the Canadian market without requiring a physical location.