Tariff Classification & Treatment

Tariff Treatment & Trade Agreements:

As of March 4, 2025, the trade landscape between Canada, Mexico, and the United States has experienced significant changes due to new tariffs imposed by the U.S. government. President Donald Trump announced a 25% tariff on imports from Canada and Mexico, effective from midnight on March 3, 2025.

This development affects existing trade agreements, including the United States–Mexico–Canada Agreement (USMCA), which was designed to promote trade among the three countries by reducing or eliminating tariffs.

Under the USMCA, imported goods that met specific origin requirements and were accompanied by proper documentation at the time of importation benefited from reduced or eliminated tariff rates, thereby encouraging competitiveness and easing the importing process. However, the newly imposed tariffs override these preferential treatments, leading to increased costs for importing goods between these nations.

In response to the U.S. tariffs, Canada has announced retaliatory measures, including a 25% tariff on $30 billion worth of U.S. goods, with plans to extend these measures to an additional $125 billion in the coming weeks. These escalating trade tensions have raised concerns about potential economic slowdowns and increased consumer prices across North America.

Importers and exporters within these countries must now navigate this altered trade environment, factoring in the additional tariffs when considering the cost and viability of cross-border transactions. It is essential for businesses to stay informed about these changes and adjust their strategies accordingly to mitigate potential financial impacts.

Full list of newly implemented Tariffs HERE.

Make sure you have the proper documentation at the border: Certificate of Origin Form Adobe PDF.

Tariff Classification & Treatment:

A tariff is a tax that gets imposed on imports & exports from one country to another. Classification is the process of determining the proper 10 digit code for importing and exporting goods to determine the associated cost added on to the goods at the border.

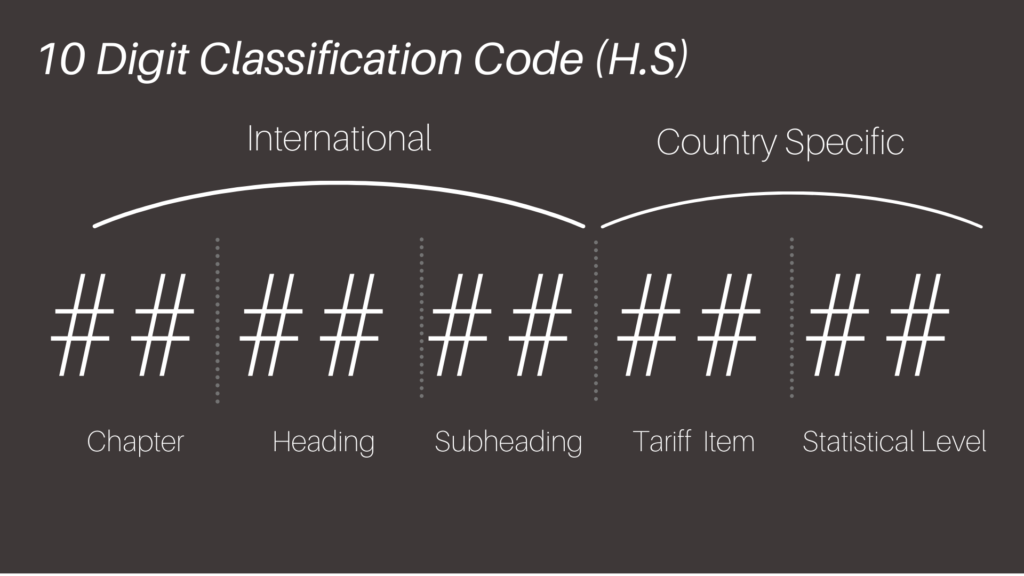

The CBSA recognizes the internationally used Harmonized System code (H.S code) which consists of 10 digits to help identify each good.

Shown on the right is the basic breakdown of the H.S code. The first six digits represent the international part of the classification number and used by all countries that recognize the HS system. Following are the last four digits which are country specific and reflect Canadian tariff and statistical requirements.

For any goods imported into Canada, using the HS Code is mandatory for classification and important to do properly.

GST & HST for Non-Residents

GST

HST

Harmonized sales tax (HST) combines the federal Canadian goods and services tax (GST) and provincial sales taxes (PST). View the full list of provinces that use the HST structure and their rates HERE.

For imported goods that are meant for commercial use throughout Canada, GST/HST will be applied at Customs. This tax is collected by the CBSA on behalf of the CRA

Canadian Customs Clearance

There are three different options for invoicing when shipping to Canada:

- a Canada Customs Invoice (CCI) which either you or the vendor can complete;

- a commercial invoice containing the same information as a CCI; or

- a commercial invoice which indicates the buyer, seller, country of origin, price paid or payable and a detailed description of the goods, including quantity, and a CCI that provides the remaining information.